Monte Carlo Fashions Ltd (MCFL) presents an interesting case study in the Indian apparel market, particularly for investors seeking opportunities beyond the typical high-growth tech sectors. While not always in the spotlight, MCFL, with its established brand presence and strategic market positioning, deserves a closer look. This analysis delves into the company’s strengths, growth drivers, and potential risks, providing a comprehensive overview for informed investment decisions.

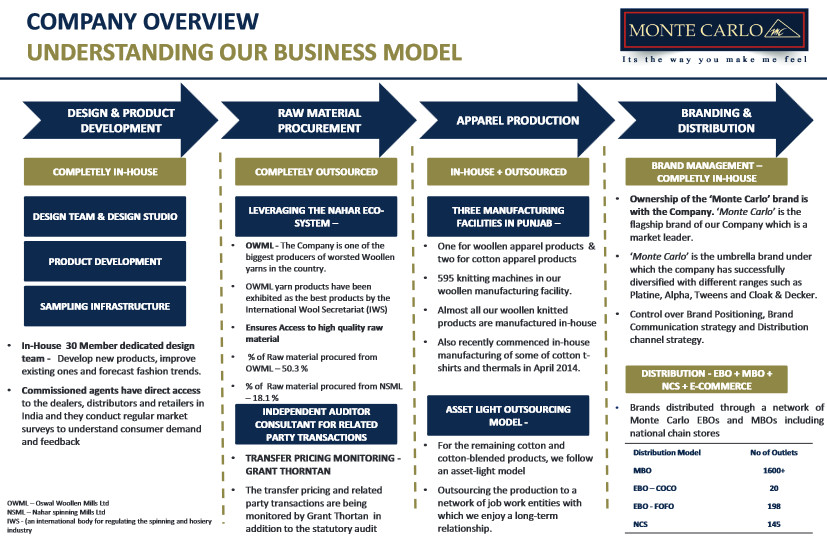

MCFL is primarily recognized for its strong foothold in the North Indian woolen wear market. Having built a reputation over decades, the brand “Monte Carlo” is synonymous with quality winter clothing in this region. Consumers in North India readily purchase their sweaters, cardigans, and knitted garments, especially during the peak winter season. While woolen wear remains its core strength, MCFL also operates in the cotton wear segment, leveraging its brand recognition to expand its reach, though brand recall for cotton apparel is comparatively lower. Both segments, however, are currently demonstrating positive growth trajectories, contributing to the company’s overall performance. Understanding the business model is crucial, and the following visual representation provides a clear picture of MCFL’s operations.

Product Portfolio and Revenue Streams

A detailed look at MCFL’s revenue distribution across product segments reveals the dominance of woolen wear, yet also highlights the growing contribution from other apparel categories. The company strategically balances its portfolio to cater to diverse consumer needs and seasonal demands. Analyzing the historical revenue distribution offers valuable insights into the company’s product strategy and market adaptation over time. The chart below illustrates the segment-wise revenue breakdown, showcasing the proportions contributed by different product categories.

Geographic Market Penetration and Expansion

Currently, MCFL’s primary market is concentrated in North and East India, regions with pronounced winter seasons driving demand for woolen apparel. However, the company is strategically expanding its footprint into South and Central India. This expansion strategy necessitates a shift in product focus towards cotton wear, as these regions experience milder winters. While MCFL is not as strongly associated with cotton wear, leveraging the established “Monte Carlo” brand name is key to gaining traction in these new markets. Success in these regions will hinge on effectively marketing their cotton apparel range and capturing market share in a competitive landscape. The geographic revenue distribution, as depicted below, underscores the current regional concentration and highlights the potential for growth in untapped markets.

Growth Catalysts for Monte Carlo Fashions

Several factors are poised to drive future growth for Monte Carlo Fashions Ltd. The ongoing expansion into South and Central India represents a significant growth opportunity. Although these markets are less reliant on woolen wear, the focus on cotton apparel, backed by the established MC brand, holds considerable potential. While market share growth in these regions may be gradual initially, sustained efforts can yield substantial returns over time. Furthermore, the company has been steadily increasing its retail presence. Since its IPO, MCFL has expanded its retail network by adding 22 outlets, bringing the total count to 220 from 198. This expansion enhances brand visibility and accessibility, directly impacting sales. Operationally, MCFL is well-positioned to capitalize on its existing infrastructure. With no major capital expenditure planned in the near term, the company is expected to benefit from operating leverage, translating into improved profitability as revenue grows.

Potential Risks and Challenges

Investing in MCFL, like any company, involves inherent risks. A key consideration is the company’s association with the Nahar Group. MCFL is owned and managed by the Nahar Group, which has multiple listed entities, including Nahar Spinning Mills. Notably, Nahar Spinning Mills is a related party, manufacturing cotton wear for MCFL on a job work basis. This related party transaction warrants scrutiny, particularly given the Nahar Group’s historical performance. Concerns exist regarding shareholder wealth creation within other Nahar entities. Another significant risk factor is the high seasonality of MCFL’s business. A substantial portion of sales is concentrated in the winter months due to the dominance of woolen wear. Achieving year-round revenue stability is dependent on the successful growth of the cotton wear segment. However, the branded cotton wear market is intensely competitive. While MCFL enjoys a niche position in woolen wear, establishing a strong foothold in the cotton wear segment presents a different set of challenges due to established players and brand preferences.

Investment Valuation and Entry Point

Currently, MCFL is trading at a P/E ratio of 15.53, which is comparatively lower than some other branded apparel stocks in the Indian market. For instance, Indian Terrain Fashions Ltd trades at a higher P/E multiple. This valuation suggests that MCFL might be undervalued relative to its peers, potentially offering an attractive entry point for long-term investors. This analysis is not intended as short-term trading advice, but rather to highlight the potential of MCFL as a long-term compounding investment. Further investigation into promoter quality and corporate governance practices within the Nahar Group is advisable to comprehensively assess the investment proposition. Understanding why MCFL trades at a lower valuation compared to industry peers, and gauging the extent to which promoter quality concerns are factored in, are crucial aspects for further due diligence.